Total leverage calculator

Youre now controlling 100000 with 1000. It peaked at 1138 trillion in October 2007 and has fallen below a half trillion dollars in early 2020.

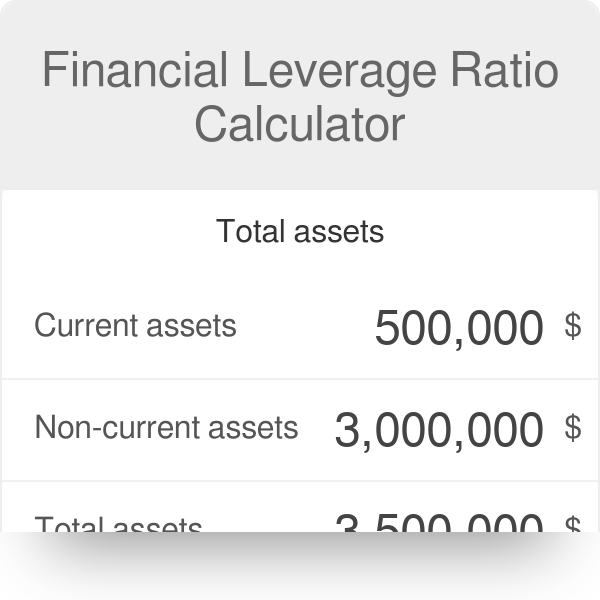

Financial Leverage Formula Calculator Excel Template

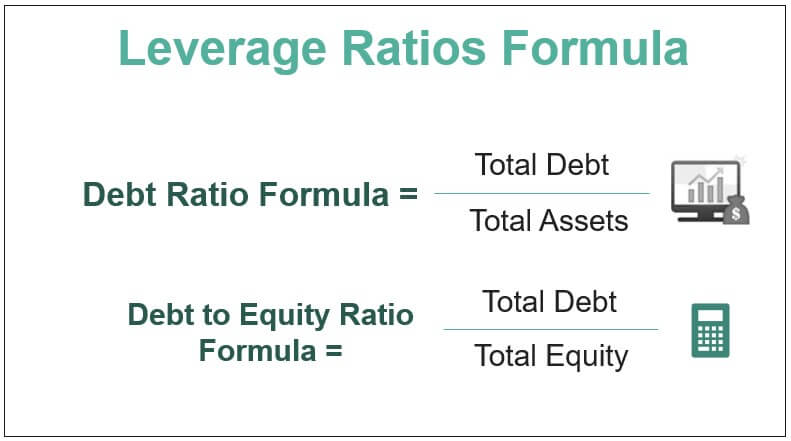

The debt to equity ratio DE is calculated by dividing the total debt balance by the total equity balance as shown below.

. The calculator will use the current real-time prices for exact values. For example buying the EURUSD at 10000 with no leverage to take a total loss the price must go to zero or to 20000 to double your investment. Check ask and bid prices.

Warm up with 5 to 10 minutes of light cardio first or do this after a workout or a bath when your muscles are warm. Calculating SGPA is a fairly easy process. Financial Leverage Formula Calculator.

For the remainder of the forecast the short-term debt will grow by 2m each year while the long-term debt will grow by 5m. Safe order price deviation. This comes out to 225mm as the.

From base order. Hold each stretch for 10 to 30 seconds and repeat one to three times. Firstly determine the cost of production which is fixed in nature ie.

This calculator includes PMI and automatically subtracts closing costs which typically ranges between 2 to 5 of a homes purchase price from the downpayment amount. Convert CGPA to Percentage using CGPA Calculator. For example if you scored 7 in Maths 10 in English 9 in French 10 in Science and 8 in Social Studies then your CGPA.

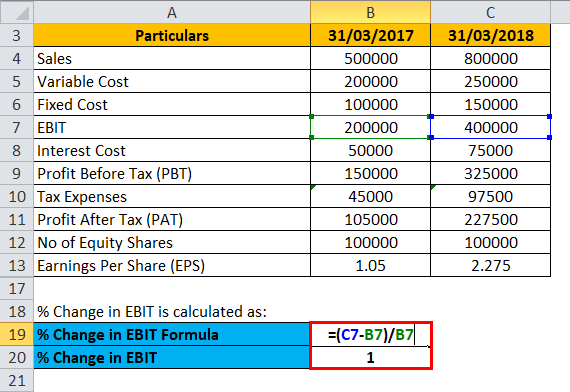

Now let us calculate the financial leverage for all the years using the above information. Leverage can be defined as The employment of an asset or source of funds for which the firm has to pay a Fixed Cost or Fixed Return This fixed cost or fixed return remains constant irrespective of the change in the volume of output or sales. Total QTY Total volume.

You will need a chair exercise ball or bench to sit on. Total fixed expenses are 30000. FREE formatting APA MLA Harvard ChicagoTurabian 24x7 support.

Calculators Multifamily Mortgage Calculator Cap Rate Calculator NOI Calculator DSCR Calculator LTV Calculator Debt Yield Calculator Cash on Cash Return Calculator Yield Maintenance Calculator. For Company ABC the total sales were 100000. In other words it is the ratio between total net open positions to total margin on your deposit.

Specify the leverage that you use for trading. Manipulative price action todayclosing this trade around 172 Avg Entry was 1735 Was updating the close around 173 in last update because due to technical glich couldnt reach. Quickly calculates down-payment ranges for common down-payment amounts states what percent of a purchase a specified down-payment represents.

If you trade using the full. For example for a USD account with leverage 1100 and the current forex prices as of writing the margin cost would be. Anti-Liquidation Calculator 3Commas Trading Bot Simulation Binance Futures DCA Bot Calculator.

How to convert CGPA to Percentage Formula. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Here total sales are equal to total revenue of a company.

There you have it. 175 with 10x leverage going long. Net Carbs is calculated by removing the fiber and some sweeteners from the total Carbohydrates.

17700000000 Target 2 at 17900000000 and stop loss at 17100000000. Total Debt 13437 for 2016 17286 for 2017 and 21230 for 2018. Web analytics is the measurement collection analysis and reporting of web data to understand and optimize web usage.

You may insert your preferred askbid prices or let the calculator use the latest prices set by the market. For example if you are total grade points are 200 out of 25 credits you need to divide them with your total credits ie. Without knowing the margin requirement at different leverage ratios you might be throwing your entire account on one single position and if you are using.

Here is how to calculate SGPA. Avoid any exercises that cause pain or discomfort and only stretch as deep as you can. For example your leverage is 11000.

Calculate accurately the amount of funds used to open a trade based on lot size and the leverage offered by your broker. Review your writers samples. In forex to control a 100000 position your broker will set aside 1000 from your account.

Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3. One of the most important aspects of risk management in leveraged trading is to be able to calculate your own margin requirement for each position you open in forex stocks and commodity trading. Total Cost 20000 6 3000.

The 1000 deposit is margin you had to give in order to use leverage. Operating Leverage Calculator Excel Template Download. The total second mortgage debt outstanding went above a trillion dollars in early 2006.

Hit Calculate After you click Calculate you will see the results below. Web analytics applications can also help companies measure the results of traditional print or. Well now move to a modeling exercise which you can access by filling out the form below.

The formula for total cost can be derived by using the following five steps. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of. As an example a recipe with 10 grams of Carbs per 100 grams that contains 3 grams of erythritol and 5 grams of fiber will have a net carbs content of 2 grams.

About About Us Leadership Team Deals Contact For Lenders Affiliate Program Coming Soon Were Hiring 800 567-9631. Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness. The variable expenses are 60000 and fixed costs are 30000.

Get 247 customer support help when you place a homework help service order with us. Order Deviation Reserve. Thus the total equity in Year 1 is 175m for the balance sheet to remain in balance.

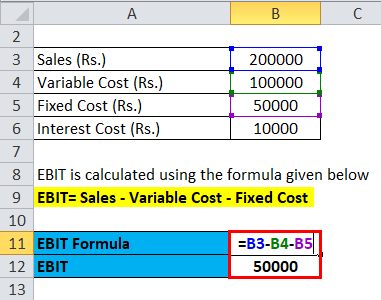

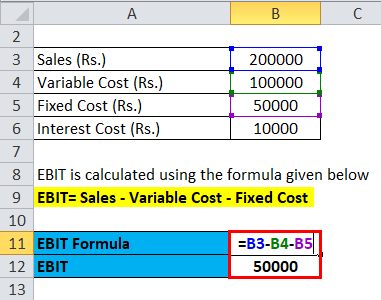

That cost which do not change with the change in the level of production. Forex Crypto Margin Leverage Calculator. Operating income.

A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily. Total Cost 38000 Explanation. Some examples of the fixed cost of production are selling expense rent expense.

Your leverage which is expressed in ratios is now 1001. Total Equity 48461 for 2016 52816 for 2017 and 63986 for 2018. How to Calculate SGPA.

Now we are ready to calculate the contribution margin which is the 250mm in total revenue minus the 25mm in variable costs. Due to a falling interest rate environment and first mortgages charging lower rates than HELOCs many homeowners have opted for cash out refinancing. Operating income is total sales less variable and fixed expenses.

Why is margin important. Currency pair - the currency youre trading. Add the GPs of 5 subjects excluding the additional subjects and simply divide the total by 5 and the result will be your CGPA.

Operating Leverage Ratio Analysis Double Entry Bookkeeping

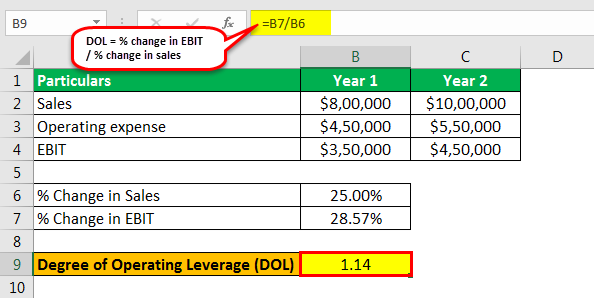

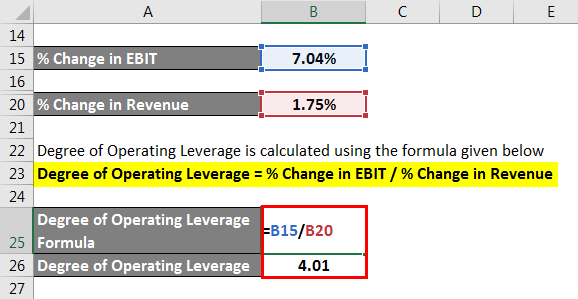

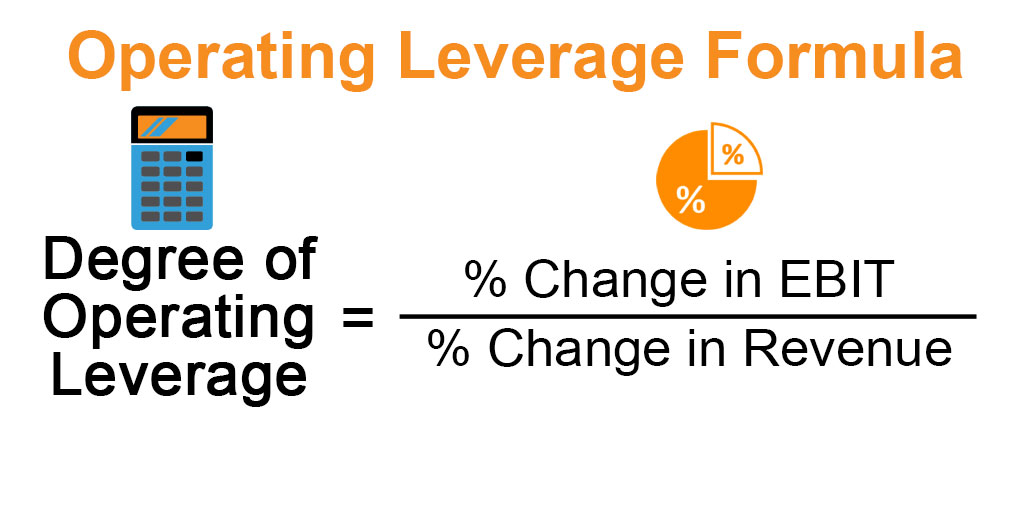

Operating Leverage Formula And Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula And Calculator Excel Template

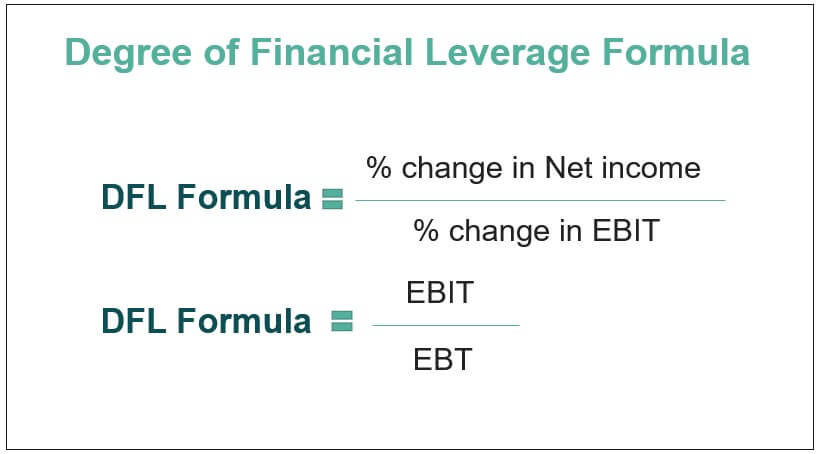

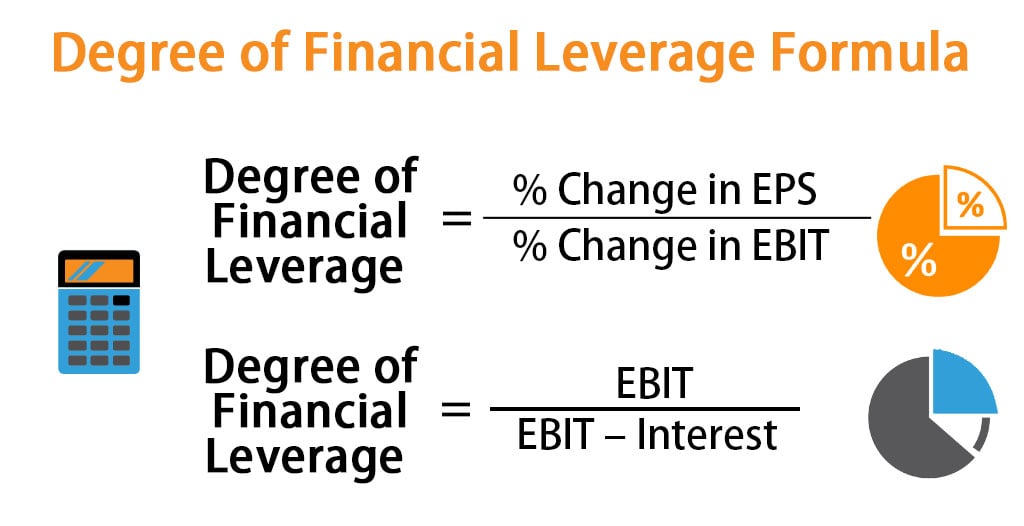

Degree Of Financial Leverage Formula Step By Step Calculation

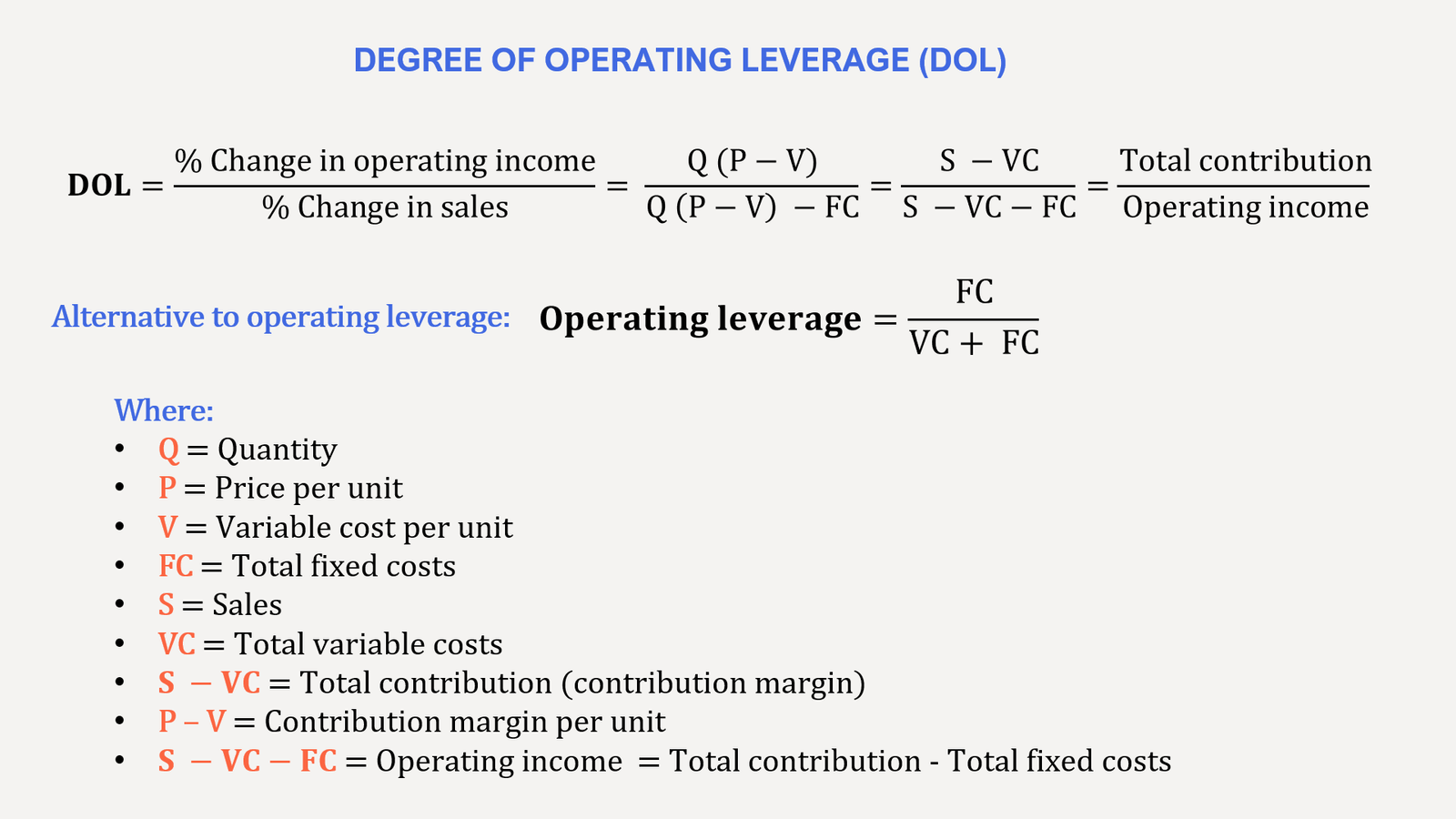

Degree Of Operating Leverage Formula Calculation Examples

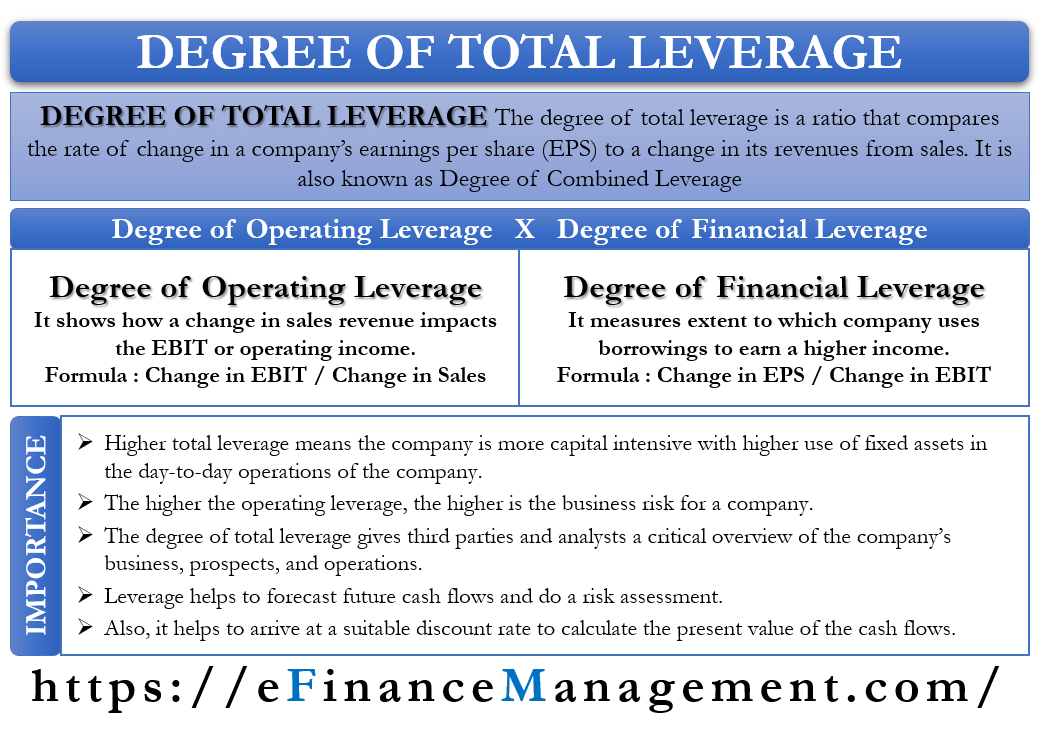

Degree Of Total Leverage Dtl Formula And Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Financial Leverage Ratio Calculator Formula

Leverage Ratios Formula Step By Step Calculation With Examples

Operating Leverage Formula Calculator Example With Excel Template

Operating Leverage Why It Matters How To Calculate It Penpoin

Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula Calculator Example With Excel Template

Degree Of Financial Leverage Formula Calculator Excel Template

Degree Of Total Leverage Meaning Calculation Importance Interpretation

Operating Leverage Formula And Calculator Excel Template